February 15, 2024

Image created by DALL·E, an AI model developed by OpenAI.

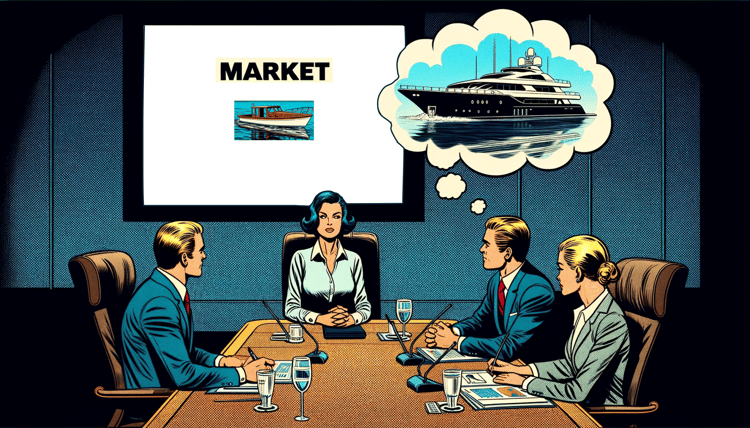

Avoid the Top Mistake in B2B Market Entry: Market Sizing Tips to Keep It Real

When entering a new market, the #1 mistake B2B companies make is overestimating the market’s size. This leads to misallocation of resources, which can shrink the ROI or, in a worst-case scenario, wreck the business plan.

If a pessimist sees the glass as half empty and an optimist sees it as half full, then a firm entering a new market typically sees it has holding twice as much water as it does.

Going to market is exciting, whether the GTM strategy involves entering a completely new market or expanding into a related one. Nobody wants to be the person who pours cold water on the enthusiasm.

But it needs to be realistic enthusiasm. Rarely do organizations underestimate the size of the potential market. The tendency is to overestimate. Following are some tips to help keep it real.

Science + Art

Market sizing is as much art as science. The science is relatively straightforward and involves estimating the number of potential customers for a product or service and the potential revenue, which stated simply is Average Revenue Per Customer X Number of Potential Customers. (Note: If you have multiple offerings and/or price points for different market subsegments, it gets more complicated.)

The art is getting the assumptions and related estimates behind the science correct. Here are some things to look out for to ensure the market sizing assumptions are realistic.

TAM, SAM, SOM.

Many market sizing approaches utilize the TAM, SAM, SOM methodology.

Total Addressable Market (TAM) is the total potential market for a product or service. Do not be seduced by this number; no firm ever captures the whole market.

Serviceable Addressable Market (SAM) is the subset of the TAM that will realistically purchase your product or service given factors like features, cost, geography, etc. This level of detail on prospective customers can be difficult to estimate; be mindful of the limitations of the data sources you are working with (part of the “art” of market sizing).

When analyzing SAM, consider the intensity of rivalry among competitors and be realistic about your product or service capabilities and competitive advantage. This can be difficult; in the enthusiasm for entering a new market, the tendency is to overestimate capabilities and advantages. This analysis can also be done as part of the SOM evaluation, but doing it here provides a more realistic estimate of the true SAM.

Serviceable Obtainable Market (SOM) are potential customers in the SAM who would purchase your product and who you can acquire as prospects in the near and medium term. Don’t forget to consider length of the sales cycle in determining near-term SOM. Even if your product or service is the next Big Thing, in markets with long sale cycles, potential customers may not be able to buy it for a year or even longer.

Pay attention to the O in SOM. Obtaining leads and prospects in your SAM takes time and effort. There are a lots of ways to go about obtaining leads and prospects; like anything else in business you can do it fast, cheap or good—pick any two.

Getting the market sizing right enables firms to allocate and focus resources more effectively, increasing the chance of success in the new market and boosting ROI.

To discuss market sizing for your organization, contact us.